|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

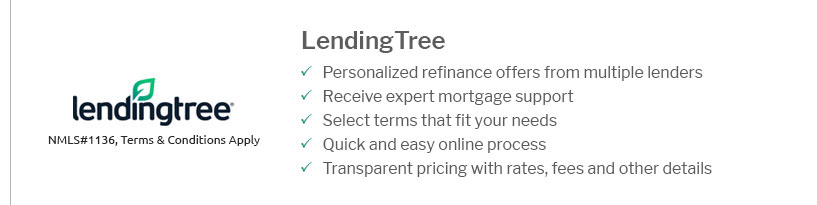

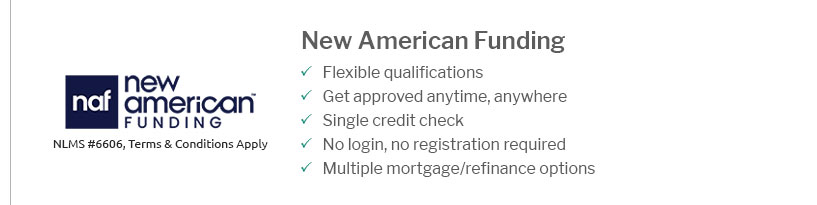

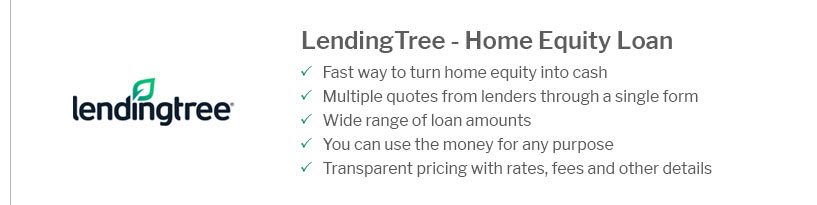

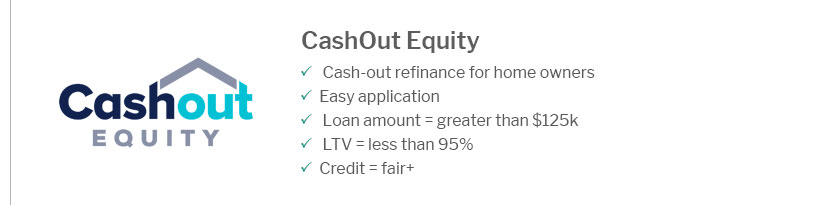

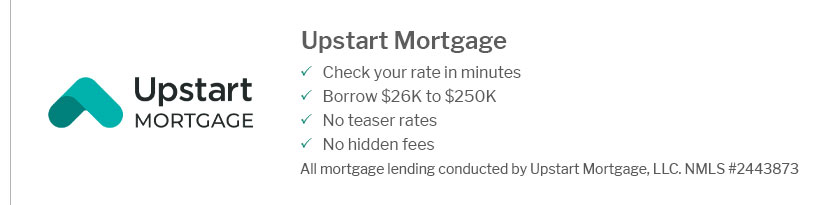

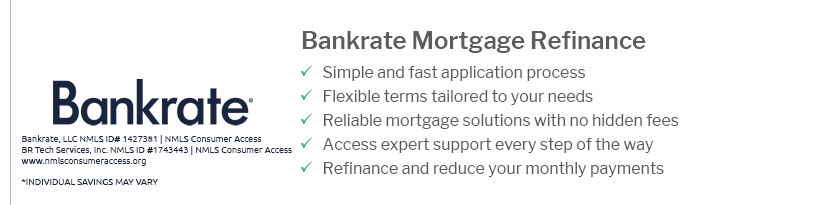

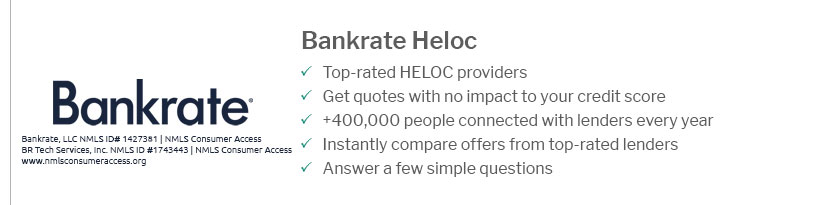

Mortgage Loan Companies in the USA: A Comprehensive GuideWhen considering a mortgage loan in the USA, choosing the right company is crucial. This guide provides insights into major players, types of loans, and how to navigate the mortgage landscape effectively. Major Mortgage Loan CompaniesThe United States has a diverse range of mortgage loan companies, each offering unique benefits and services. Top Lenders

Choosing the Right CompanyWhen selecting a mortgage lender, consider the following factors:

Types of Mortgage LoansUnderstanding the types of mortgage loans available can help you make an informed decision. Conventional LoansThese are traditional loans that are not insured by the federal government. They usually have fixed or adjustable rates. Government-Backed Loans

Navigating Mortgage RatesMortgage rates fluctuate based on various economic factors. Keeping track of these changes can save you money over the life of your loan. Understanding Rate TrendsIt's crucial to monitor current mortgage rates and understand how they impact your loan. To learn more about current trends, see what are harp rates today. FAQWhat is the difference between a fixed-rate and an adjustable-rate mortgage?A fixed-rate mortgage maintains the same interest rate throughout the life of the loan, providing predictable monthly payments. An adjustable-rate mortgage (ARM) has an interest rate that may change periodically based on an index, leading to variable monthly payments. How can I improve my chances of mortgage approval?Improving your credit score, maintaining a low debt-to-income ratio, and saving for a larger down payment can enhance your mortgage approval prospects. It's also beneficial to gather necessary documentation ahead of time. Are there any first-time homebuyer programs available?Yes, there are several programs for first-time homebuyers, including FHA loans, state-specific assistance programs, and down payment grants. These programs are designed to make homeownership more accessible. https://www.carringtonmortgage.com/

Loan servicing and loan modification information from Carrington Mortgage. Make online payments, review account details, payment history, change personal ... https://www.experian.com/blogs/ask-experian/largest-mortgage-lenders/

10 Largest Mortgage Lenders in the US - 1. Rocket Mortgage - 2. United Wholesale Mortgage - 3. Bank of America - 4. Fairway Independent Mortgage - 5. https://www.cnbc.com/select/largest-mortgage-lenders/

United Wholesale Mortgage - Rocket Mortgage - Bank of America - Fairway Independent Mortgage Corporation - CrossCountry Mortgage - U.S. Bank - Navy ...

|

|---|